HOME

HOW IT WORKS

REPORT TYPES

FAQ

Excessive fees & charges by KiwiSaver providers can impact your savings and retirement in a negative way.

The Money Guard Report will show how your current provider’s fees affect your savings.

Have you ever thought about what happens with your money once it’s gone to your KiwiSaver provider?

Your KiwiSaver funds are your investment and your KiwiSaver provider is in charge of your money until you retire, so make sure your provider is your best fit.

Different KiwiSaver providers charge different fees; some higher, some lower. These fees may not seem like much today, but in the long run, the higher the fees, the smaller your retirement fund will be.

You may be missing out on thousands of dollars. Order your Money Guard Report now to find out.

Purchase a Money Guard Report

Fill in your personal and KiwiSaver details and choose which tier report you would like to purchase.

Compare fees with other providers

Receive an analysis of your current KiwiSaver fees and compare them to other potential providers.

Optimise your KiwiSaver returns

See how much money you can save on KiwiSaver provider fees so you can maximise your investment.

Purchase your Money Guard Report today to see how you can potentially save thousands of dollars on fees with another KiwiSaver provider.

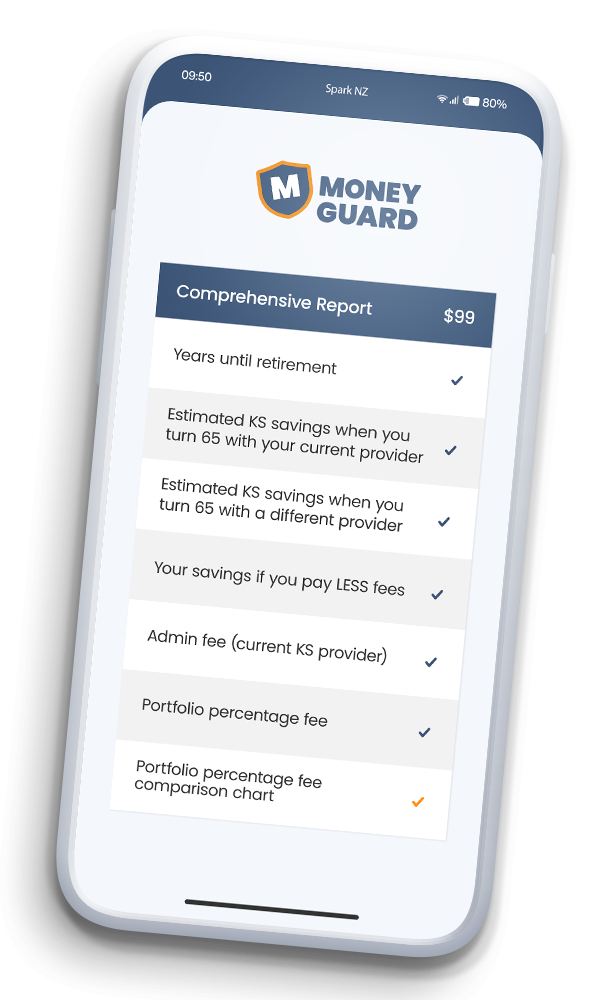

Your Money Guard Report will give you the tools to optimise your future savings, today! Our standard report offers you insight into how you sit with your KiwiSaver provider in terms of fees and allows you to make an informed decision on your savings.

The Elite comprehensive report also gives you a list of other KiwiSaver providers and their fees to give you a full view of other options you have for your KiwiSaver funds.

| Standard Report | $69 |

|---|---|

| Years Till Retirement | |

| Estimated KS savings when you turn 65 y.o. with current provider | |

| Estimated KS savings when you turn 65 y.o. with different provider | |

| Your Savings if you pay LESS fees | |

| Admin Fee (current KS Provider) | |

| Portfolio Percentage Fee (current KS Provider) |

| Comprehensive Report | $99 |

|---|---|

| Years Till Retirement | |

| Estimated KS savings when you turn 65 y.o. with current provider | |

| Estimated KS savings when you turn 65 y.o. with different provider | |

| Your Savings if you pay LESS fees | |

| Admin Fee (current KS Provider) | |

| Portfolio Fee Percentage | |

| KiwiSaver Provider Fee Comparison Chart |

“You need to act now if you want to set yourself up for a comfortable retirement. Every day that goes by, high fees erode your investment fund. If your KiwiSaver provider’s fees are high, you could be missing out on thousands of dollars.”

Do you know what happens to your hard-earned KiwiSaver money once it is deducted from your pay? If you haven’t taken control of your KiwiSaver investment, it may not be working as hard as you are.

Most KiwiSaver providers charge an annual admin fee, plus a portfolio fee based on a percentage of your KiwiSaver fund. The more money you save, the higher your fees. But these fees vary significantly between fund managers.

Money Guard founder and accountant Valerie Rowe-Mitchell created Money Guard Report to give people the tools they need to make informed decisions on their investments.

The Money Guard Report is created for you. It is very confidential, secure, and not propped by any of the KiwiSaver providers.

Valerie believes it is never too soon or too late to make changes to your KiwiSaver investment to set yourself up in the best position for the future. To avoid missing out on thousands of dollars, the sooner you act, the better.

Valerie Rowe-Mitchell | Founder, Money Guard NZ

KiwiSaver fees vary greatly between providers, and some are not upfront with their fees. We give you the tools you need to make an informed decision on your retirement investment.

A Money Guard Report will give you a sneak peek into the future of your KiwiSaver fund. You will find out how your current KiwiSaver provider compares to other KiwiSaver providers.

The Standard Report is $69, and the Comprehensive Report is $99.

You will be prompted to pay once you have filled in your contact details. Simply click on the Purchase Report button (or click here) and follow the prompts.

You will be required to fill out the following information: name, age, email address and basic information about your current KiwiSaver Fund.

Money Guard will email your report to the email address you have provided. Please ensure it is entered correctly. We aim to get back to you within 5 working days.

Once you have received your Money Guard Report, you can choose to change your KiwiSaver provider. Your money, your choice!

© 2021 Money Guard | Website Designed & Built by Digital Pie Limited